MEFA Pathway, our free college and career planning portal for Massachusetts students in grades 6-12, features age-appropriate activities based on student grade level. After a student sets up an account profile on mefapathway.org with their graduation year, the system will generate suggested activities and age-appropriate content. For example, a grade 7 student will view different suggested activities than that of a grade 11 student. For middle school students, features are tailored to be especially fun and engaging. Key aspects include:

Personal Profile

Students use My Profile to add their clubs, sports, honors, awards, extracurricular activities, and community service to build a foundation for a resume. They will continue to build upon this over the years so when they need it for a college or job application, all pertinent information will already be saved.

My Digital Portfolio

My Digital Portfolio is a visual representation of the student’s Profile and other work within MEFA Pathway, and it documents the student’s journey through college and career planning. The portfolio can grow and change as students learn more about themselves, identify affinities, and grow their aptitudes and accomplishments. It helps to instill a sense of relevance early on that supports dreams and ambitions.

Dashboard

Students can use the Dashboard to view certain tasks relevant to their planning for the future. As they complete different activities, they can earn virtual badges to encourage use and progress. The games available for the middle school grades are fun, engaging, and intuitive while facilitating exploration and discovery in several areas:

- Everyday Things allows students to explore careers related to things they are familiar with or that they enjoy. Students select two areas of interest and then view a short list of related careers.

- Says Who exposes students to various careers by identifying on-the-job tasks.

- Favorite Subjects shows students the connection between the subjects studied in school to potential college majors and career options.

- Would You Rather allows the student to answer a series of questions to help discover career clusters of interest.

Self-Discovery

Students in grades 6-8 also have access to the Self -Discovery tab, which includes three assessments where students can learn more about themselves by identifying their interests, values, and skills, and applying their results to extensive career exploration. Students are encouraged to retake and reassess results annually to identify trends and differences that emerge. These activities guide students in further building postsecondary plans.

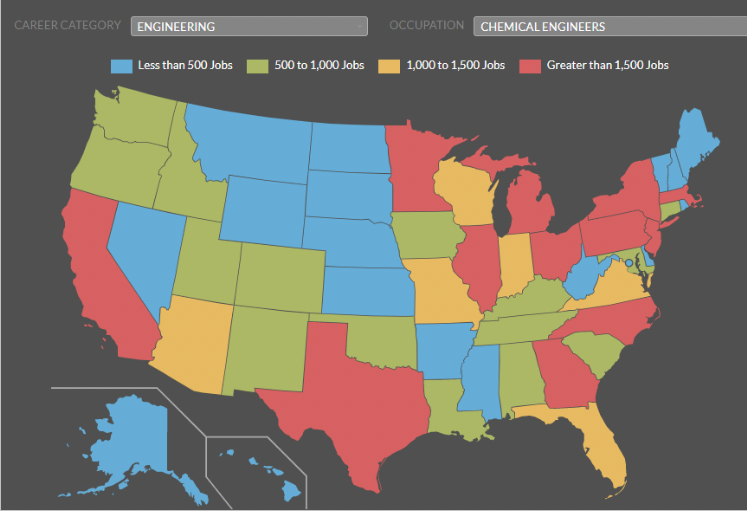

Investigate Your Future

Middle school students also have access to the Investigate Your Future feature, which includes four activities where students can learn about top trending skills and occupations, projected growth of careers, areas of the country that have the highest concentration of certain occupations, and exploration of various career paths. Updated labor market information populates the presented data, showing connectivity between career goals and opportunities existing at both the state level and nationwide.

Financial Planning

Middle school students can explore financial literacy topics in MEFA Pathway such as budgeting, compound interest, and protecting their personal information. Students can use the My Goals feature under the Self-Discovery tab to set goals related to money management and budgeting, such as saving up money to purchase a certain item or experience and creating a strategy to achieve it by a certain date.

Within the My Budget page under the Financial Planning tab, students can learn what a budget is and then create their own by using the My Monthly Budget Calculator.

Want to learn more about MEFA Pathway? Watch our MEFA Pathway videos to find out about other activities and features within this free-of-cost college and career planning platform.