Resources Mentioned in this Episode

Jonathan Hughes: Welcome to Navigating the Course to College series within the MEFA podcast. My name is Jonathan Hughes and I’m the Associate Director of College Planning and Education at MEFA and I’m on my behavior today because I’m joined by the Director of College Planning and Education at MEFA, Julie Shields-Rutyna. Hello Julie.

Julie Shields-Rutyna: Hi, Jonathan. Does that mean I have to be on my best behavior as well?

Jonathan Hughes: [No, no, no. In fact it would probably be more interesting if you weren’t, actually, since this is your first time on the podcast. Jonathan and I sort of introduced ourselves in the first episode, do you want to just talk for a minute about who you are and how long you’ve worked at MEFA and you know, it’s like one of those meetings where everyone goes around the table and says two or three things about themselves?

Julie Shields-Rutyna: Oh, well, sure. So I have been working at MEFA for 14 years, but I have been in this field of, I guess I’d call it higher education financing, for a number that I hate to say, but upwards of something like 30, 35 years. Working at colleges and working in other organizations, all organizations that help students go to college and help families pay for it.

But my home has become MEFA. I really, I like it because I’m able to do all of those things.

Jonathan Hughes: That’s great. Yeah. And you’re known industry-wide, so it’s like every place I go that has more than a few organizations, they say, oh, do you know Julie? Yes, of course. I know Julie.

So you cast a long shadow, so that’s good. Well today is doubly exciting because on the show, we will also have one of our favorite collaborators. Yiming Shuang and Christine from Inversant. This is college savings month, as I’m sure you all know, and Inversant is a partner of MEFA in the BabySteps Savings Program along with the Massachusetts Treasury.

And we’ll talk all about that and all the other great work that Inversant does in our interview segment with them. And of course, like every other episode, before we do that, we’ll reach into the MEFA mailbag and discuss some questions that are percolating in the minds of students and families this time of year.

And this year in particular, in this very strange year. So maybe one of the questions that they have is a question that you have, but to start us off, the news marches on, and there’s been a lot of stories about how colleges are coping with COVID. You’ve probably seen some of them, but Julie, do you want to give us a rundown of the top stories of the past few weeks?

Julie Shields-Rutyna: Sure. Well, one story that caught our eye was actually from WBUR. And it’s not a great story. It was a report that showed that the number of students in Massachusetts who filed a FAFSA this past year had dropped and dropped by, you know, something like 2300 students. And that’s a 5.1% decline since last year, which is actually even steeper than the national decline this year, which was 4.3%. We didn’t like to hear that.

Jonathan Hughes: No, no. And so I think I know, but why do they think that this has happened? Is it because of the virus?

Julie Shields-Rutyna: Yeah, I think that at the time when families would have been filing, which would have been last fall and last winter and last spring, obviously, you know, the world sort of changed in the late winter.

And then I think there was so much uncertainty about what college is going to look like and people being at home and not in their regular routines and trying to do things remotely. And we always find that we have to do a lot of it encouraging to make sure that everyone knows they should file a FAFSA.

That’s the free application for federal student aid and help people to know how to do that and when to do that. And so I think the unusual year, just really haven’t had that, that slight negative effect.

Jonathan Hughes: Yeah. And did they know, you know, where the drop is coming from? What students in particular aren’t filing or why?

Julie Shields-Rutyna: Well, in fact, it really is probably the students who need the aid the most that didn’t file. And so, again, that’s a little bit of a discouraging fact, but it makes sense. So the report showed that for high schools that are known as title one schools, where 40% of the families are under the poverty line, the rate of non-completion almost doubled.

So. You know, again, I think it’s just, those are the students that we reach out to, and that we try to encourage and help complete that form. And with all of the COVID 19 issues that started around March in this area, I think a lot of that, you know, was just went by the wayside. I will say the good news because, you know, hey John, I hate to dwell on bad news.

The good news is that MEFA put together a plan and a lot of our colleagues, other organizations, I think have a really good plan for this year. So one example is just that as you know, MEFA is going to have college financing webinars almost every day, starting in a couple of weeks, all the way through when the FAFSA opens on October, all the way through October into November.

So that, and we’re really going to push families to attend one of those webinars and learn everything they need to do. And I know some of our other organizations that we work with, MassEDCO is one, and some of the equal opportunity centers around at the colleges. They’re all gonna be on that as well.

Jonathan Hughes: Yeah. And, I know I’m gathering my strength for our big push, so where we’re going to just be constantly doing these webinars and offering these services. And that’s something that we always are careful to stress. Whenever we talk to families and students in quote unquote, normal years, that there’s a lot of free help available.

And so it’s even more important that people know that this year it’s coming from MEFA, that’s coming from other places like the organizations that you mentioned as well. So definitely seek out that help because it is there. Now speaking of COVID and the fallout from that, we’ve seen a lot of stories about what’s going on on campuses.

So Julie, how was the beginning of the academic year going on college campuses so far?

Julie Shields-Rutyna: Well, it is a mixed bag and I think we’re going to continue to hear stories. It seems that there’s a new story every day, coming from campuses all over the country, really, but it’s the type of year that we’ve never had before.

So we’re seeing things such as some campuses have invited students back to college and with that colleges have elaborate plans. Some of them do some more elaborate than others on social distancing rules and COVID testing policies. So there’s all of that, but we’ve heard stories that there are cases, students are getting COVID on college campuses.

And colleges are dealing with that in different ways. Some, you know, some have quarantine rules. We did hear some cases where colleges sent students home. So it really differs from college to college. But we also have heard of students, you know, going to parties and things, which shouldn’t be any surprise in some way that college student are having parties, but you know, that’s violating some really serious rules on college campuses.

And so we’re seeing some colleges take a really hard stance on that. And we’re seeing others maybe turning a blind eye and then receiving some criticism for that. So this is going to be something that I think we’re just going to have to watch. And I know that all college administrators are really watching this and hopefully some best practices, you know, some learnings come out of this. And I think we’ll learn from the mistakes too, but I think people are doing the best they can, but it is going to be a wild ride this fall, I think.

Jonathan Hughes: Yeah, and it may not end in the fall too. We’ll see. I mean, you know, we were sort of all looking to the fall to see what was going to happen and how colleges were going to handle this.

And now we’re seeing it. And we don’t know if the fall is the end or if we’re going to run into the same issues in the spring. I hope we don’t obviously, but it’s definitely, it’s a good point. Now, finally, I think in some sort of comparatively happier news. There’s some new developments for possible, and you know, this is, nothing is final.

Everything is just proposal at this point, but a possible 529 expansions in a new bill that was unveiled in Congress. So do you have any details on that?

Julie Shields-Rutyna: Well, yeah, just that there’s a stimulus bill that the two parties are wrangling over right now. And the Republicans in the Senate have introduced a bill that includes some flexibility to 529 plans. And this new flexibility would allow parents of students in kindergarten through 12th grade at any public private or religious schools to use 529 plans for expenses like books, online materials, tutoring, things that they may have to deal with that they haven’t had to deal with pre COVID.

And this, it’s just, it would be a bill. It would be a proposal that would go into effect for two years, but it would be an expansion of the qualified expenses. So we’ll keep people posted about how that turns out. But what I think it’s good news is it just seems as, you know, John, that over the last couple of years, we’ve seen the qualified expenses for 529 really expand and become more flexible, little by little. And I think all of that can help to encourage families to save. And we just know the benefits of putting away some money for college. And I think each time there’s the plans become a little more flexible. Then I feel more people may be encouraged just to say, all right, this is now I’m going to say, I have less of an excuse because of this matter, this or that question.

Jonathan Hughes: Absolutely. Absolutely. So good news, good developments. We’ll see what happens. Now we’re gonna head on over as we always do to the MEFA mail bag, and these are questions that students and families either called us with or emailed us. And if you want to ask us a question, you can email us at [email protected], or you can call us.

It could be a question that we read next, but our first question comes from Patel who called in this week to ask us what the difference is between the U.Fund and the U.Plan. So since this is college savings months, we’re going to have some college savings questions that folks have asked. And this is the first one, and this is kind of like if somebody calls up and asks this question, get comfortable, it can be a long call.

It’s going to be a long conversation. It’s not going to try to get through this as succinctly as possible. And it’s a big question. So the difference between the plans are ways that U.Fund is a 529 plan. And this is how it works. You put money into the U.Fund or whatever 529 plan.

But in this case, it’s the U.Fund. So you put money in the U.Fund. ]Fidelity, who MEFA has contracted to service the accounts and manage the investments, they invest the money that you put in. The money grows tax deferred. So you don’t pay federal taxes on the earnings. And if you use the funds for qualified educational expenses, which we just kind of talked about, but quickly again, are tuition fees, room and board, books, supplies and equipment for higher education.

Or it can be for up to $10,000n related to K through 12 expenses, apprenticeship programs, or up to $10,000 in repaying student loans. So all of those things are what are considered qualified expenses. So if you use your 529 money for that, you don’t pay any federal taxes on the earnings. So that’s essentially sort of the high level of how 529 plans work.

So the U.Plan is different. It’s the Massachusetts prepaid tuition program. And you put money in and depending on how much money you put in, you buy a certain percentage of tuition at each participate in college and the program. So every participant in colleges in Massachusetts, they’re over 70 participating private and public colleges.

So you put the money in, you don’t have to pick the college up front. What you do is you put money in and you pick the year or years that you want to use the funds in. So one or more of the years that the child is going to be in college. The funds are not invested in the market, but they’re invested in bonds that are backed by the Commonwealth and they do accrue interest.

But the real point of the program is that when you put money into the plan, it freezes or locks in tuition, or whatever, percentage of tuition you buy in a given year for the year that you have selected. So basically it helps to give an example. If you put in a thousand dollars, let’s say this year and you say, okay, my son is going to be a freshmen in 2031, for example.

So that’s what I want to use this money. Well, I put it in a thousand dollars. That’s going to buy 10% of tuition at a college that costs 10,000 as of dollars this year. Now, if he goes to that college in 2031, and tuition is now $25,000. You have 10% of that or $2,500. So your $1,000 became 2,500 because you locked in 10% of tuition at that college.

So the value of your percentage grows at the same rate that tuition grows. And so that’s what we mean when we say you can freeze tuition or lock-in tuition. You can add to your percentage throughout the year, so you can keep on adding and get a higher percentage by the time your child goes to college. So the first question that people always have is what happens if your child doesn’t go to one of those participate in colleges.

If that happens, you can change the beneficiary to another student, which you can also do with the U.Fund. So if one of your students doesn’t end up going to college or is not able to use the funds for whatever reason, you can transfer that to another student. Or in the case of the U.Plan prepaid tuition program, you can always get what you put in, plus the interest back, with no penalty on that.

No Massachusetts state tax penalty or federal. So that is essentially the difference between the U.Fund and the U.Plan. And now you don’t have to choose one or the other, you can do both. I have one of them, I won’t say which one it is at this point, but I do have one of them. U.Plan is for tuition and fees that you can use the U.Fund for room and board and things like that.

So if you’re able to do that, it’s a great thing to do, but as we always say, any way that you can save is a good way. It’s better than not saving at all. But these two ways have sort of added benefits of specific benefits that come with them when they’re used for college. So is that, does that, is there anything you wanted to add to that Julie?

Julie Shields-Rutyna: I guess I would just add that I have both. And I’ve used both for my kids. That has worked out very well for me.

Jonathan Hughes: Yeah. I do know that you’re a U.Plan customer? I forgot that. Cause you and I have talked now, if I may, I have a seven year old son who I’m saving for, well I guess I’ll spill the beans, out of a U.Fund.

I’m saving for him every month, but I do, you know, children, one of them has graduated and one of them is in college now. Right? So we kind of have talked and I say this to parents all the time, you know, I’m trying to do this just like you are. Right? So, and we talk about saving and we’re talking, I actually, you know, I’ll say what I do say sometimes to folks in our college savings presentation, which is a conversation that you and I had, Julie. Which is when you said that the best thing that you did was save, right. Starting to save and absolutely. Yeah, go ahead. No, sorry.

Julie Shields-Rutyna: Oh, no, just no, you’re so right.

It’s absolutely that when it came time, when that fall came around to send my first student to college, just knowing that I had some savings. And I did not have enough savings for everything. But knowing that I had some savings and also my kids got some financial aid. And so, you know, it helped me put together a plan so much easier if I didn’t have any savings, I would have been a lot more anxious about the whole thing.

And I think the whole thing would have been and would continue to be a whole lot more difficult.

Jonathan Hughes: So. Yeah, no, I think that’s really, really important for people to know. It’s not that you have to save everything, but just having it there, having some of it there really helps. So, you know, I hope you don’t mind, but I always say, I don’t think we would, but I always relay that to folks. Now our next question came into us and it was a question about whether or not 529 funds could be used for a career technical Institute. We talked all about college and that’s a lot of what we talk about, but of course, as we say, as well, not everybody goes to college and everybody needs to go to college.

And one of the great things it’s about a 529 plan is that they are flexible. So you can use them at any accredited college in the country, but it doesn’t have to be a college. So, you can use 529 funds at international colleges, if they accept you as federal funding, but you can also use them for vocational programs, technical certificate programs, as long as they’re accredited and can accept you as federal funding.

So it would depend on the actual institution itself, but as Julie alluded to earlier, just so many uses qualified uses for 529 plans and the trend is more flexibility and more eligible expenses to be used. So it’s a good trend. Now our final question comes from Nancy, who’s a new mom.

Congratulations, Nancy. She writes, can I open a 529 plan for a newborn beneficiary who has not yet been issued a social security number? We talked about this, so Julie, why don’t you go have a crack at this one?

Julie Shields-Rutyna: Sure. Sure. Well, so in order to fill out a 529 application, the beneficiary has to have a social security number.

So you really can’t set up the account for a newborn if the newborn doesn’t have one yet. However, over time we come into contact with lots of planners, lots of people who want to plan, and we want to encourage that. So that’s great. So the way around that is that if people want to open a 529 plan before, you know, maybe when someone’s pregnant or just even knowing that that’s going to be in the plan for the future. Someone can open a 529 plan and name themselves as the beneficiary, so they can be both the owner and the beneficiary.

And then once the baby is born and then the baby has a social security number, they can just go and change the beneficiary. So that’s how that would work. So guidance is if you are a planner and you want to plan, go for it. That’s great. Lately we’ve started to get questions from people who are, you know, about to have a baby, you know, they’re really close to having a baby.

And in that case, we sometimes say, well, just wait. And you usually get the social security number within three weeks time of when your baby is born. So you might as well just wait and set it up. And then the baby has the social security number. But, again, that’s the easiest, but we wouldn’t discourage anyone from planning.

And there is a nice way around that.

Jonathan Hughes: Yeah. It was like, love the enthusiasm to set one up, you know, even before there’s a baby here, this is social security number. But like you said, if it’s really, it doesn’t take a long time to get the social security number. And it’s a lot easier if you probably just wait a little bit there.

Especially, I think the person Nancy who called in, I think was a new mom. So it’s just going to be a couple of weeks before that social security number comes and probably easier right now, if you just hang on for that time and wait. And it might come into that BabySteps program, if you’re a new mom in Massachusetts, right?

And you sign up for a U.Fund. You’re going to get that $50 in the BabySteps Savings Program. But you know, in order to be eligible, the beneficiary has to be born after January 1st, 2020 in Massachusetts. So probably easier to wait for that. And then to transfer later on and then see if you get the seed fund.

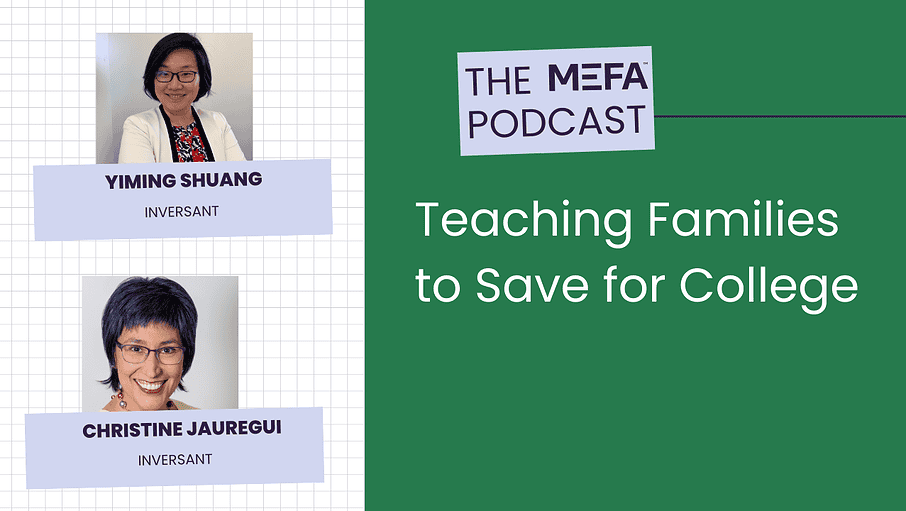

But we have Yiming Shuang from Inversant to talk all about that in our next segment, but that is it for the mailbag. So we can close that up. And again, remember if you have any questions you can call us or email us at [email protected]. Now, finally, for our last segment, you will hear my interview with Yiming Shuang and Christine from Inversant. And they are a really exciting organization in the Boston area that does a lot to promote college savings and has worked with me on a lot of exciting projects, including the BabySteps Program, which is probably the biggest, newest, most exciting project that we have. So let’s have a listen to that now.

Now for our guests for college savings month, Yiming Shuang as the Chief Operating Officer for Inversant and Christine Jauregui is the Director of Marketing Communications from Inversant. And Inversant provides children’s savings accounts through college access programs. Inversant works with low to moderate income families who live in the greater Boston area and since 2009 has helped them to save over $1.6 million with $1.2 million matched.

What I wanted to do first is talk a little bit about Inversant. Inversant is a big partner of ours in the BabySteps program, along with the Massachusetts Treasury. So before we actually get into the BabySteps program, if you could tell anyone who’s listening, and may be interested, who is Inversant is and what they do and how families can interact with them.

Yiming Shuang: Sure. Inversant is a pretty small non-profit. We’re based at Copley Square Boston. We really miss being there. We’re all working remote. Now our mission is to help families plan and invest in higher education. We have served over 2000 Massachusetts families. Mostly in the underserved community since 2009. We offer support in incentives to kick start their college savings.

We also provide workshops about financial aid and college planning process, but in short, whenever we interact with a family, we really talk about whenever that we’ll use the words save for college. It has multiple layers of meaning. So one is like, start an account and save for college.

Second is, we usually say, oh, we save them a big deal by cutting back the expenses. So we teach families how to research your expenses. Looking for ways to cut back on what they don’t need to spend. And then the last part is thinking of as many strategies to get financial aid as possible, no matter scholarships, we also offer scholarships.

So that’s where, when we say save for college, that’s how we serve our families.

Jonathan Hughes: Now when do families and students start to engage with Inversant and how can they do that?

Yiming Shuang: Usually, in our traditional model, we partner with mostly local high schools. And then for example, Chelsea High School. So we used to only serve high school families.

Then a couple of years ago, we started expanding to younger graders. Cause a lot of these families, they have younger kids and they also realized they need to start saving early. So then we started expanded and become a K-12 program. And then, throughout our pandemic, actually right before then, we started thinking about a lot of these parents, of course, we really meet families where they’re at.

So like I want to go to college too, or they start thinking about their own education. So, we’re just gradually little by little, it takes a village, but also we’re trying to bring the whole village to college. So that approach that we’re doing, so we’re really gradually expanding and then trying to meet families needs where they’re at.

Jonathan Hughes: I was really, really excited to hear that you were developing that strategy or that focus towards bringing in the parents or more adult learners into the process. Because I think, you know, so much of the, the focus is on families and students, traditional students in high school or below.

And there is a need there. So I thought that was really, really great. I’m glad you brought it up. But before I start talking about the pandemic and everything that’s changed there. Tell me, how did you come to this line of work? And what sort of did you learn doing this work that surprised you?

Yiming Shuang: Yeah. So I moved from Taiwan. Like I came to Boston for grad school at BU. It’s kinda, I feel like it’s serendipity. Before I came here, my family, especially my mom, she’s been raising me and my sister on her own. And it’s been her lifelong dream that we get the best education.

And so as the foreigner, we think U.S. education is really the golden standard. Like better life, better opportunities for jobs. So that’s what, like, we never had our own house or car. Like she just save up her entire life to send us to grad school. And then what’s really interesting is then after I graduated in 2009, we hit the biggest depression, like in the economy.

So most of my peers, they couldn’t find a job. So they had to move out of Boston right away. And they had to pay back the high cost of living. They have to start paying their student loans. And fortunately cause that my mom like saved the entire amount, so I didn’t have any loans.

So I really started from zero, like started interning, with the founder of Inversant. Bob Hildreth and he’s an investment banker philanthropist, but also an economist. And he also had always have unique ways and ideas to see how U.S. education system can be improved and extending access and promote equity.

And that’s really how Inversant got started, that he really wanted to help a lot of first gen and immigrants family to get to college. And I personally feel like because of where I came from, and also I really feel bad, could relate to these families, like starting from nothing, like not knowing what FAFSA is, what Pell grant means.

But then really see it from their eyes and how they can achieve the U.S. education, like how I came from. But then they just need, you know, more push and more lending hands of how to overcome those systemic barriers in affording college and taking potential financial risks.

Jonathan Hughes: Wow. That is great. Now, since you mentioned. Bob Hildreth and Inversant and you know, it is such a big figure in this field and it has done so much great work. And then you talked about meeting families where they are. And that’s really what I think of when I think of Inversant and thought in particular.

But that makes me think of all the programs that we did together, starting with the AC, the 529 programs that we did earlier and now with BabySteps. When we mentioned BabySteps a little bit earlier in the show, but I thought it would be, you know, such a big part of the program along with the Treasury.

If you could just give anybody who’s listening out there who may be eligible for BabySteps a little walk through of the program and what it is and how they can take advantage of that.

Yiming Shuang: Like a little shout out right. Should be doing, so BabySteps it’s really, it’s a long way coming.

Like it really took us like teammate for like several years, like learning from, you know, the groundwork that Inversant’s been doing. And then collaborating on all these pilot program are led by the Treasurer’s office and MEFA. And then, so I always get very excited and emotional when we talk BabySteps.

And, so, in short is like for any Massachusetts family will have a baby or adopt child after January 1st. 2020, they’re eligible to open a MEFA U.Fund account with a free $50 seed. And I can’t tell you enough, like being a mother of two young children myself, this is a significant step to start investing in a child’s education and future.

And having that ease of your mind because there will be, well, there are so many upfront costs. When you, the first two years when you had a baby and then you don’t want to like wake up at night and say, Oh my God, what happened? Like next? Like what about college? It’s going to be so much more expensive by the time our children go to college.

And I can’t even share enough, like I had, I was very fortunate that I get to visit some BabySteps hospitals right before pandemic. And then of course we can’t do this anymore. But that pure joy and hope like family had was their new borns and wanting to wanting them to have everything like the best thing in the world.

So my quick shout out is if anyone is expecting a baby, like I’ve been doing this. I’ve been going around all Massachusetts a couple years. Cause if you’re expecting a baby now, the process is really simple. Like you just need to check a box on your child’s birth certificate when you’re at the hospital, when your baby’s born.

And then you’re going to receive all the follow-up information from MEFA and the Treasurer’s office to open that account.

Jonathan Hughes: You’ve been managing during the pandemic. What have you been doing that? So that’s a bit different. And what, what are some of the challenges or the successes?

Yiming Shuang: We used to really rely on face to face meetings, to connect with our families and communities.

And now that we all work remotely, we’ve been testing different outreach channels just like you’re doing podcasts. Like we’re trying like Facebook live or different kind of mediums and see what works. And then we still, but at the same time, we’re still keeping that personal touch with a family, because usually when we do a campaign or outreach, then we get like flood of family come like calling us.

And we’re using that as an opportunity to check in with them and see how they’re doing. I would say like one of the most fun memory we had since the pandemic start is we try to organize a remote pizza party for all the class of 2020 families. And that was quite an operation at the beginning. We started was like, oh, should we just like Uber eats this pizza to families?

And then we like really contact the local pizza joint and then got them, you know, and then we work on that every single city, like how we’re going to figure out like delivering 20 pizza and Salem in one night.

Jonathan Hughes: Wow. Do they work out? That’s a cool idea. Did it work out?

Yiming Shuang: Yeah. I mean, it’s a lot of work. If you want to replicate that model, you need to talk to us.

Yeah. But family really love it. And that just bring us that memory. When we were back then, like still in a community meeting, like enjoying hot meals together. And that’s what the least we can do is like bring pizza to their household and they can celebrate their kid’s graduation.

Jonathan Hughes: That’s nice. One thing I was, I do remember quite fondly from our events together is that there was always very well fed.

Yiming Shuang: So yes. Still trying to figure out how to get a taco truck on the road. More tacos.

Jonathan Hughes: Good. Well, thank you so much. It was so nice to have you here on the podcast. You will run when we were talking about who we’re going to get on the podcast. We were one of the first people that we thought of to have as a guest.

And now I want to talk to Christine. Who is the Director of Marketing Communications at Inversant. Because when we were on as we sit on a few groups together and this one being the Massachusetts CSA program, which is a group of folks who offer college savings accounts like Inversant does with their programs and like MEFA does with BabySteps. And then this Boston program called Boston Saves, and there’s all sort of different local organizations that are involved in putting money away for kids in the community or matching funds.

And so Christine was speaking about a new program that Inversant was launching, a scholarship program. And I want to give you the chance to talk about that right now, but first. Hello, Christine, how are, I think this might be the first time that we’re speaking, we’ve spoken before, but always virtually, but this is probably the longest sustained conversation.

Christine Jauregui: That is correct. Yes. I’ve been enjoying your conversation with the meeting. I mean, she really is this vast wealth of knowledge and experience in this still somewhat emerging field. So good choice. Yeah. So yes, Inversant recently launched a new initiative called the cash for college fund. So this is an award and we will be making 10 awards of up to $2,500 each on a rolling basis between now and October 23rd. The application period is currently open. It is an online application. It closes on October 16th. So that’s a very important date to remember, and it does take a little preparation to do the application and submit it because we ask for a number of things.

And I’ll explain in a second why we’re asking what we’re asking for. Cause that is important too. There’s a brief survey, the questionnaire that we are asking individuals to fill out. Tell us about yourself. Are you enrolled full-time, part-time, were you enrolled, are you working also studying, do you have children? Are you a single parent? So it’s basically a survey that’s asking for information about the student, because we want to make sure that we use this opportunity as a way to address, not just financial need, but also the risk that a number of students face in continuing their education as parents, as part-time students, as older than typical age college students.

And I say typical aging in air quotes because we may think of the typical college age student is, you know, somewhere between 18 and 25. But we know from enrollment information across the country that older students are actually more prevalent now in U.S. higher ed. But that risk factor still does remain if you are an adult learner, if you have children, if you’re working full-time while on a roll, these are factors that make it more difficult for you to remain in school and complete your course of study.

So we do want to take those factors into consideration. Aside from risk, we’re also looking at unmet need. So this is a fund that will award grants to students who are experiencing education related expenses that are not covered by their financial aid packages. So it’s important to remember that even students who say have a full ride scholarship, you know, where all their tuition is covered.

There still so many other expenses related to being a student. The cost of attendance is what we call that that, might be as small as $300 or $400 or $500. But if the student doesn’t have a way to address that expense, they could be in jeopardy of having to withdraw. So we recognize that there’s this gap between financial aid and total cost of attendance.

So we want to address that with this particular initiative. So I encourage anyone who meets those criteria to come to our website and prepare an application for cash for college.

Jonathan Hughes: And then the website is Inversant?

Yiming Shuang: Yes.

Jonathan Hughes: Yes. Well, thank you very much, Christine. Thank you very much. I look forward to hearing how the new program goes, and then I hope to have you both back, but thank you very, very much for joining me.

Well, thanks everybody for listening to that. Julie, how was it? Did you have a good time?

Julie Shields-Rutyna: Yeah, I did. I did. It was fun. I love podcasts. So I love being able to participate in this where we can deliver all this great information.

Jonathan Hughes: Well, I thought it went really well and I hope to have you back really soon talking about a whole bunch of other things that MEFA is doing. And I know that you probably will be back sooner rather than later. So I’m looking forward to it. Thanks everybody for listening. Join us next time, please visit us at mefa.org. Email us with any questions at [email protected], and remember to like or subscribe to the podcast which you can find at Spotify, IHeartRadio, Apple podcasts, and wherever you get your podcasts.

Thanks so much everybody, talk to you next time.