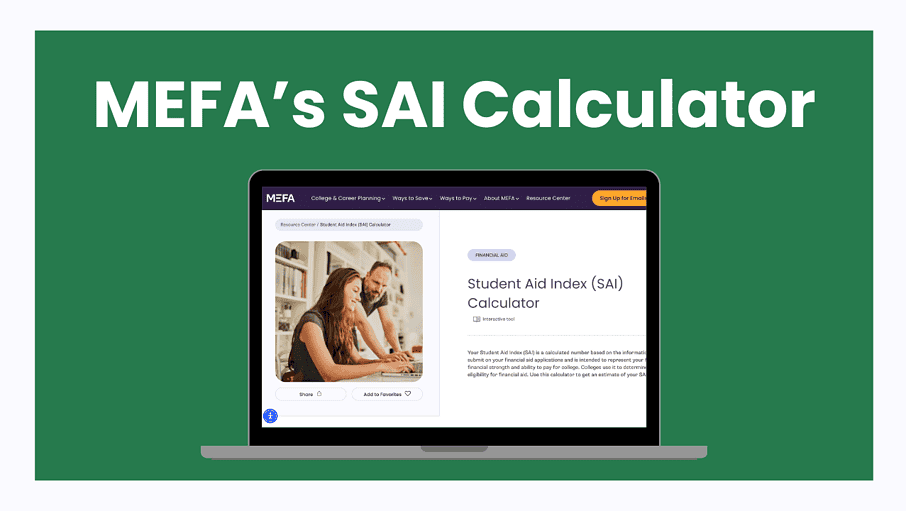

Your Student Aid Index, also known as your SAI, is a number colleges use to determine your eligibility for financial aid. MEFA’s SAI Calculator allows you to type in information about your family’s finances and receive an estimate of your SAI. Our video provides a quick tutorial on how to use the calculator. Get your SAI estimate by using MEFA’s SAI Calculator.

Please note that this transcript was auto-generated. We apologize for any minor errors in spelling or grammar.

[00:00:00] Your Student Aid Index, also known as your SAI, is a calculated number based on the information you submit on your FAFSA and is intended to represent your family’s financial strength and ability to pay for college. Colleges use this number to determine your eligibility for financial aid. MIFA provides an SAI calculator that allows you to type in information about your family’s finances and receive an estimate of your SAI.

Our SAI calculator is anonymous, so you won’t need to provide identifying information like your name or your address. To use it, start by going to MIFA. org slash SAICalculator. Type in your state of residence and the number of people in your household. Next, fill in the finance information of the student’s parents.

This includes adjusted gross income, income tax paid, filing status, income, untaxed income, [00:01:00] and cash and investments. You’ll need to indicate if the parents own a farm or a business, what was included in the AGI, and if the parent receives child support. The chart on the right showcases the calculated parent contribution toward the SAI.

And the different colors of gray and green distinguish the amount of SAI calculated. from the income and from the amount calculated from assets. You can see here that the SAI is heavily driven by income rather than assets. Next, you’ll fill in financial information for the student, including adjusted gross income, income tax paid.

income, untaxed income, and cash and investments. And finally, the calculator will present you with your estimated SAI. The results will also show you how your SAI will be used by colleges. You can generate a report to download your results and save them for later. You can play around with the [00:02:00] calculator over and over, especially if you’re considering a job change or significant decrease in your assets.

And remember, if you don’t yet have a child going to college, your information might be different once it’s time to send someone to campus. But this tool can give you an idea of what colleges might expect you to contribute towards college costs when the time comes. Use the calculator at MIFA. org slash SAICalculator.